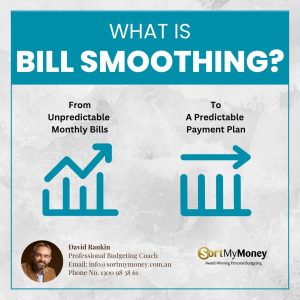

Don’t let irregular utility bills catch you off guard! Discover the benefits of bill smoothing, a powerful financial strategy that ensures consistent and predictable payments. In this article, we delve into the details of bill smoothing, explaining how it works and why it could be the key to maintaining your financial equilibrium.

Understanding Bill Smoothing

Bill smoothing involves your service provider deducting a regular and uniform amount from your account. This amount is calculated based on your historical usage patterns, allowing you to avoid the stress of irregular and unexpected bills in the future.

Optimal Timing for Bill-Smoothing Debits

For maximum effectiveness, schedule bill-smoothing debits to occur at least one day after your payday. This strategic timing aligns with your cash flow, ensuring that you have sufficient funds available without causing any financial strain.

Will You Give It a Try?

Considering bill smoothing for the first time? It’s a proactive step towards financial stability. If you’re already on the bill-smoothing journey, we’d love to hear about your experience and any tips you have for others.

Get in Touch

For more information or if you have any enquiries about implementing bill smoothing, feel free to email us at info@sortmymoney.com.au. Our team of financial experts is here to assist you on your path to financial mastery.