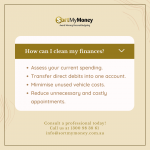

𝐒𝐭𝐚𝐫𝐭 𝐬𝐥𝐨𝐰 𝐚𝐧𝐝 𝐬𝐦𝐚𝐥𝐥 𝐢𝐟 𝐲𝐨𝐮 𝐡𝐚𝐯𝐞 𝐭𝐨, 𝐛𝐮𝐭 𝐬𝐭𝐚𝐫𝐭 𝐧𝐨𝐰. Getting ahead of life might sound like a dream, especially when you have a big vision for the future. However, learning the basic skills now will help propel you to the right path. Financial literacy is not a competition, but an early start gets you closer to your savings goal. 𝙇𝙚𝙖𝙧𝙣 𝙖 𝙢𝙤𝙣𝙚𝙮 𝙨𝙠𝙞𝙡𝙡 𝙩𝙤𝙙𝙖𝙮! Need professional advice? Email us at info@sortmymoney.com.au.